Bank Ledgers & Tax Management

A business can only rule commercially if its financial empire works perfectly. As companies expand, so does the intricacy of handling taxes and bank transactions. Tax management and bank ledgers are critical functions that play a role in maintaining compliance and stability in the financial system. To achieve this perfection, we have developed a deskbook. cloud, a Saas-based accounts management solution that enables companies to handle the complexities of several taxes, such as sales tax, VAT, GST, and holding tax, and to reconcile bank transactions.

Bank Ledgers & Tax Management Key Features:

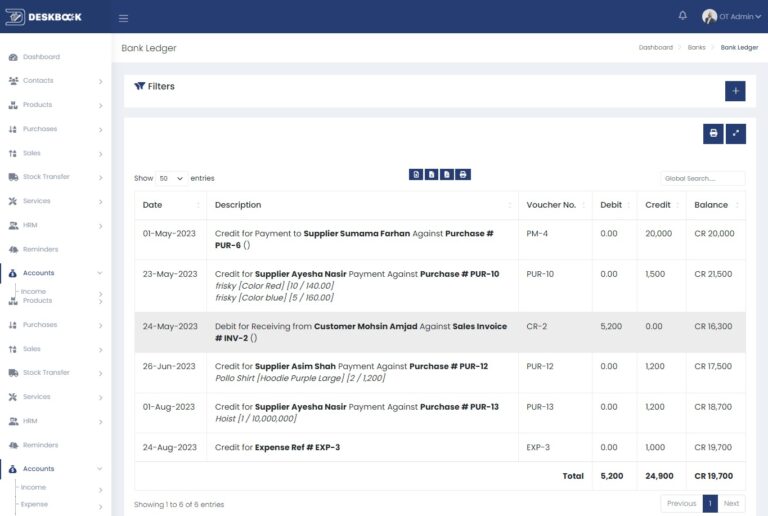

Bank Transaction Reconciliation

Accounts handling depends on keeping accurate records of current bank ledgers. Your company’s financial records must match the actual transactions that take place in your bank accounts. This is ensured by reconciling bank transactions. Deskbook.cloud offers a user-friendly platform that automatically reconciles bank transactions on time, eliminating the issues from this process.

Important characteristics

Automatic Matching: You don’t have to manually go through countless statements to match transactions. Our system uses clever automation to easily equivalent the records on your bank statements to those you have documented.Error Detection: Our system’s sophisticated error-detection features will notify you if there are any variances. This proactive strategy enables you to address problems early and avoid financial disparities.

Handling Taxes with Accuracy

For companies of all kinds, navigating the complicated tax landscape can be difficult. In addition to providing a thorough method for handling different taxes, such as sales tax, VAT, GST, and withholding tax, our online solution streamlines the procedure.

Management of Sales Tax

You can quickly keep track of and compute sales tax on your transactions.

Produce comprehensive reports for auditing and compliance needs.

Management of Withholding Taxes

Simplify the withholding tax deduction and remittance process.

Easily create reports and certificates for withholding tax.

Keep up with any modifications to the rules and rates governing withholding tax.

Smooth Integration

Deskbook. cloud is unique because it integrates seamlessly with other financial software and applications. Our platform guarantees a coherent and integrated financial ecosystem, regardless of whether you’re using payroll systems, invoicing software, or accounting software.

Combining Accounting Software with Integration

Quickly establish a connection with widely used accounting software to synchronize financial data. Make sure that all financial reports and records are consistent.

Integration of Invoices

Integrate billing tools to streamline the invoicing process.

When invoices are issued or paid, financial records should be updated automatically.

Integration of Payroll

To keep accurate records of employee transactions, payroll data must be synchronized.

Make it easier to calculate taxes using paycheck information.

Product Management

Beyond tax management and bank reconciliations, deskbook. cloud may also be easily integrated with your product management workflows. Businesses can comprehensively understand their operations by integrating product data with financial transactions. Our platform ensures that your product-related financial data is linked in real-time, whether processing orders, keeping track of inventories, or assessing sales performance. In addition to improving productivity, this integration offers insightful data on product profitability, enabling you to make well-informed business decisions.

Purchases and Sales with Bank Transactions

Purchasing, sales, and bank transactions working together harmoniously is a critical component of our all-inclusive system. Your bank ledger automatically updates with the appropriate financial entry whenever a sale or buy is made. By doing away with redundant human data entry, this integration lowers the possibility of mistakes and guarantees the accuracy of your financial records at all times. Our technology makes it easier for sales and purchase transactions to be automatically reconciled with your bank statements, giving you a picture of your cash on Timely.